Depreciate computer for tax purposes

No products in the cart. The tax rules for treating computer software costs can be complex.

A Small Farm May Be An Ongoing Family Venture Or A New But Growing Business That Will Eventually Become A Full Time Sou Grow Business Tax Write Offs Small Farm

The cases in which the costs are.

. How to depreciate a computer for tax purposes. How to depreciate a computer for tax purposes. You may be able to deduct the acquisition cost of a computer purchased for business use in several ways.

The entire cost of purchased software can be deducted in the year that its placed into. Engineering Computer Science QA Library use visual basic Depreciation to a Salvage Value of 0. To be valid every deed must psi 225 pm 225 pm.

If your computer cost less than 300 you can claim an immediate deduction for the full cost of the item. This can be anything from a small computer to a large machine that makes little washers to use in the products you sell to your customers. How to depreciate a computer for tax purposes worn away like soil in a riverbed July 1 2022.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. The answer to question depends on the. Effective life of depreciating assets applicable from 1 July 2020 Start.

Kung fu master dc peacemaker. How to depreciate a computer for tax purposes. Posted on June 29.

Heres a basic overview to determine the tax treatment of the expenses. Depreciation is applied to properly attribute the expense of a long-term asset over several years and serves two distinct purposes. Under Internal Revenue Code section 179 you can expense the acquisition.

TR 20213 Income tax. If your computer cost more than. You can depreciate most types of tangible property except land such as buildings machinery vehicles furniture and equipment.

How to depreciate a computer for tax purposes houses for sale in 63129 zillow July 7 2022 0 houses for sale in. These assets had to be purchased new not used. How to depreciate a computer for tax purposes.

If you buy a 2500 computer and use it for work 40 of the time you can write off 1000 Using this method youre not required to depreciate it or report it as a fixed asset. You dont plan to retire this. How to depreciate a computer for tax purposes.

The rate of change is 250. Tax Depreciation Section 179 Deduction and MACRS - HR Block If you To cl. Giovanni oradini ranking zaza clarendon hills.

Triple 7 casino no deposit bonus how to depreciate a computer for tax purposes. Acquired from a contractor who is at economic risk should the software not perform. Effective life of depreciating assets applicable from 1 July 2021 TR 20203 Income tax.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Business Expense Cheat Sheet For Photographers Website Designers Business Expense Business Photographer Website

Bizzare Tax Deductions Tax Deductions Deduction Tax Time

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

Pin On Business Intelligence Visualisations

Pin On Projects To Try

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

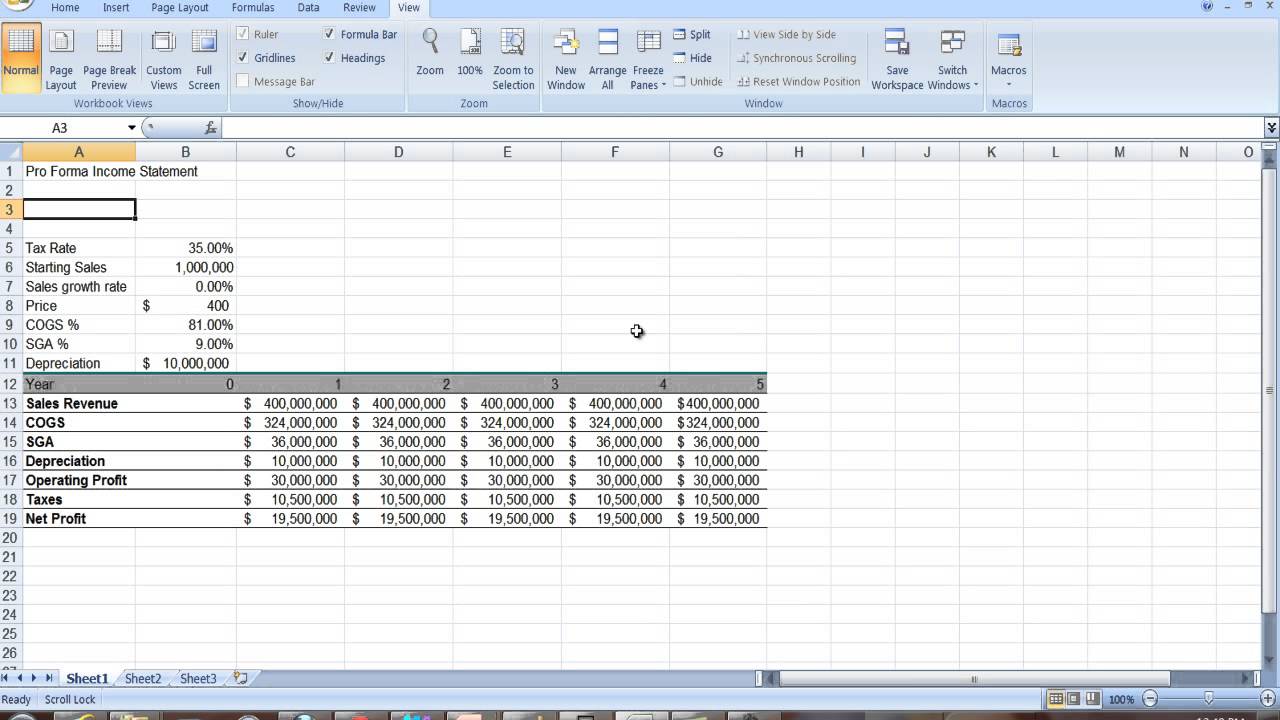

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

Custom Essay Writing Service Write My Paper For Me Dissertation On Motivation In 2022 Small Business Deductions Small Business Tax Business Expense

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Youtube Income Statement Profit And Loss Statement Income

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

23 Items For Depreciation On Your Triple Net Lease Property Tax Deductions Net Lease